R.J. (CA USA)

Medical Services

Social Services

Legal Services

Canada

Canada

U.S.A.

U.S.A.

Chile

Chile

Bolivia

Bolivia

China

China

HK SAR

HK SAR

Japan

Japan

Korea

Korea

Singapore

Singapore

Thailand

Thailand

Philippines

Philippines

测试国家

测试国家

Germany

Germany

Russia

Russia

Spain

Spain

Sweden

Sweden

France

France

Luxembourg

Luxembourg

U.K.

U.K.

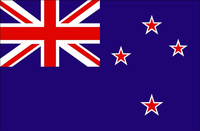

New Zealand

New Zealand

Australia

Australia

Zimbabwe

Zimbabwe

Botswana

Botswana

返回

返回