Welcome, everyone! I'm Claire, and this is Ethan, and together, we're the proud founders of the United Kingdom chapter. Our journey to the UK began in 2022, and like many newcomers to this country, we encountered challenges in navigating the plethora of available social, medical, legal, and financial resources. It became apparent that there was a need for a centralised hub to assist those seeking guidance in these areas. Therefore, we established this chapter to offer support to anyone in search of such resources. Moving forward, we are committed to continuously updating and expanding the resources available here.

How to Obtain a UK Driver’s License (Locals call it Driving Licence)

The first thing our parents did when we arrived in the UK was to apply for their UK driving licences. Also, I will be learning to drive in a year, so let’s start with UK driver’s license.

New Drivers Starting from Scratch

If you're similar to me, a novice driver learning to drive from scratch, kindly follow these steps.

Step 1: Provisional Licence

• Apply for your first provisional driving licence from DVLA (the UK DMV), but you need to be at least 15 years and 9 months old.

• Make sure that you are permitted to live in the UK for at least 185 days in a year. In another word, you cannot apply for UK driving licence on a tourist visa.

• Make sure that you are able to read a car license plate from 20 meters away.

• Pay £34 online when you apply.

• Here is the provisional licence application link: http://apply-provisional-driving-licence.service.gov.uk/

Step 2: Pass the Theory Test

• You don’t need to pass the driving theory test before getting a provisional licence, but you will need to pass it before booking and taking the practical driving test.

• There are two sections in the test:

• Multiple-Choice Section (50 questions): This part of the test assesses your knowledge of the Highway Code, road signs, and driving regulations.

• Hazard Perception Section (14 video clips, 15 hazards): In this part of the test, you'll watch a series of video clips that simulate driving scenarios. Your task is to identify potential hazards as they develop on the road by clicking the mouse. The sooner you spot a hazard, the more points you'll score (5 points maximum per hazard. If you click slightly later, your score decreases incrementally, ranging from 4 points to 1 point).

• To pass the theory test, you must achieve a minimum score of 43 out of 50 questions in the multiple-choice section and 44 out of 75 points in the hazard perception section. Passing both sections is necessary to obtain a theory test certificate, which is valid for two years and must be presented when taking the practical driving test.

• You can study for the test using the app “Driving Theory Test 4 in 1 Kit”. It costs £4.99 but well worth it according to online reviews.

• Test takers who successfully passed the exam generally recommend allocating at least five days for study preparation.

• The theory test costs £23, and here is the link to book: https://www.gov.uk/book-theory-test

• If you fail, you need to wait 3 working days before retaking the test.

Step 3: Learning to Drive

• After receiving your provisional license from the DVLA, you can commence your learning journey.

• Ensure that you are under the supervision of a qualified driver as driving alone with a provisional licence is not permitted.

• Qualified driver is defined as a person who is at least 21 years old and has had a full driving licence for at least 3 years (from the UK, the EU, Switzerland, Norway, Iceland or Liechtenstein).

• So, you can’t practice driving with a driver who only has licence from countries such as the US and China.

Step 4: Finding a Driving Instructor

• You are certainly allowed to learn driving from family and friends, but my parent told me that it was highly recommended to take a few lessons from professional driving instructors.

• Professional instructors can offer more structured guidance and help cultivate good driving habits for you, whereas family and friends may not possess the expertise to provide such tailored advice.

• UK professional instructors can also assist you in scheduling and arranging your driving test for a date of your choosing.

• Many of the instructors are highly professional and committed to helping you pass your driving test on the first attempt. While it's rare, there may be instances where you encounter an instructor motivated by profit, potentially suggesting additional lessons unnecessarily. If you run into such encounter, do not hesitate to switch instructors.

• Driving instructors usually cost around £30-40 per hour.

• The UK government hosts a website where you can find a directory of driving instructors based on your postcode. Here is the link: https://www.gov.uk/find-driving-schools-and-lessons

Step 5: Pass the Driving Road Test

• This is the final step that everybody hates and dreads!

• Overall pass rate in the UK is about 45%-50%. Not that high!!

• If you fail, you can book your next test at least 10 working days away.

• Again, your driving instructors usually have special means to schedule test appointments for you, whereas attempting to do so yourself often involves waiting months and months for an available date at your preferred test location.

• If you hire an instructor, he or she will help you familiarise with the possible routes ahead of the test, or even a few hours before the test.

• It will be easier to just use your instructor’s car for the test. However, you are certainly allowed to use your own/borrowed car for the test. If you decide to use your own car, please make sure of two things:

• You have insurance coverage for this road test.

• You will need to put the “L” signs (i.e. learner plates) in front and rear of the vehicle. You can buy those magnetic signs from Amazon easily.

• The test will last about 40 minutes, and will evaluate your ability to drive safely in various road and traffic conditions, including maneuvers like pulling over, U-turn and parallel parking.

• You're allowed to make up to 15 minor faults and no major faults during the practical driving test.

• Minor faults are ones that do not pose significant risk to safety, like failure to check mirrors before signalling, imprecise lane position, etc.

• An immediately test failure will result when you make a major fault, such as running a red light, causing other cars to brake/swerve, etc.

• A driving test costs £62 during weekdays and £75 on weekends. You can book a driving test here: https://www.gov.uk/book-driving-test

• Helpful iOS or Android apps for booking (or rebooking after failure) UK driving tests: Testi, Driving Test Cancellations NOW.

Important Tips from People Who Passed:

• The most cost effective way to learn to drive is to learn and practice with friends and family first, and then hire an professional instructor to practice 5-10 hours before taking the driving test.

• Another cost effective way to prepare for test is to watch a lot of Youtube videos offered by various instructors. Notable channels like Conquer Driving and DGN Driving boast large follower base and offer valuable insights.

• During the road test, you should act in more dramatic and exaggerated fashion so the examiner can be convinced that you are an extremely careful driver. For instance, a full turn of your head to observe mirrors will be much better than just a mere glance.

Experienced Drivers with Driver’s Licenses from Other Countries

So what if you already have driver’s license from other countries and can you use it in the UK? Or you wonder whether you could switch your license to a UK one without having to take the theory or road test?

• If you obtained a driving licence by passing a driving road test in one of the 27 member states of the European Union (EU) or three other countries within the European Economic Area (EEA) – Iceland, Liechtenstein, and Norway – then CONGRATULATIONS! You can use your foreign license to drive in the UK until you are 70 years old.

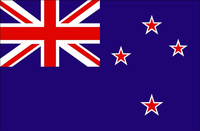

• Or if you obtained a driving licence by passing your road test from the following “Designated Countries or Territories”, which include Andorra, Australia, Barbados, British Virgin Islands, Canada, Cayman Islands, Falkland Islands, Faroe Islands, Gibraltar, Hong Kong, Japan, Monaco, New Zealand, Republic of Korea, Republic of North Macedonia, Singapore, South Africa, Switzerland, Taiwan, Ukraine, United Arab Emirates and Zimbabwe, you will be able to use your foreign license to drive in the UK for 12 months, but afterwards you will need to exchange it into a 5-year UK licence. CONGRATULATIONS, as you can perform the exchange without having to take the UK theory and practical road tests.

• When you exchange the above two type of foreign licenses into the UK ones, you will need to order and fill out a D1 form (you can order it here: https://www.gov.uk/dvlaforms), and pay an fee of £43.

• So what if your foreign license was obtained by passing road tests in countries other than the EU/EEA and Designated Countries or Territories? For instance, your license might be from the USA, China, Thailand, etc.?

• You will be allowed to use your foreign license to drive in the UK for 12 months after your arrival in the UK.

• After 12 months, however, you will need to take a UK theory test and practical road test to get a UK driving licence, just like a New Driver Starting from Scratch.

Important Caveat

It is important to note that even if you do have a driver’s license from EU/EEA or Designated Countries or Territories (“DCT”), you might not be able to exchange your license for a UK one. Specifically, if you obtained your EU/EEA/DCT driver’s license by swapping it with a non-EU/EEA/DCT license, then it will only be valid in the UK for 12 months, and after 12 months you will need to take the UK theory and practical road test to get a UK driving licence.

To be precise, the UK licensing agency DVLA will look at the exact location where you passed your driving road test. If you passed the road test in EU/EEA or DCT, then you will be able to exchange your foreign license for a UK one without further test. If, however, you passed your road test in non-EU/EEA/DCT countries, then no matter what countries’ license you hold, you will still need to do the UK theory and road tests after 12 months.

For example, my parents have many friends who originally learned how to drive and passed their road tests in Mainland China. Under an agreement between Mainland China and Hong Kong, individuals holding licenses from one territory can obtain the equivalent license in the other without additional testing. As a result, they all obtained Hong Kong’s driver’s licenses. However, upon relocating to the UK, they anticipated being able to exchange their Hong Kong licenses for UK ones, as Hong Kong was listed among the Designated Countries and Territories by the UK DVLA. To their disappointment, their attempts to exchange licenses were unsuccessful. DVLA clarified that despite holding Hong Kong licenses, they were ineligible as they hadn't passed their road tests in Hong Kong.

Financial Resources

It is important to set up local bank accounts when you move to the United Kingdom. Local banks offer essential services that international banks may lack, such as facilitating monthly direct debits, a preferred payment method by most UK utility companies for seamless payments.

When you open a personal account with UK banks, you will be given an account number and a sort code. This is something that you don’t get in other countries. So what is a sort code and how does it work?

What is a Bank’s Sort Code?

In the UK, a bank's sort code is a six-digit number that identifies both the bank and the specific branch where an account is held. The sort code system helps to facilitate the routing of payments within the UK banking system.

Here's how the sort code is structured:

• First two digits: These represent the bank's clearing house. Different banks are assigned unique ranges of numbers for these initial digits.

• Next two digits: These identify the bank itself within the clearing house.

• Last two digits: These pinpoint the specific branch where the account is held.

When making payments or setting up direct debits or standing orders, the sort code is used along with the account number to ensure that the funds are directed correctly to the intended account within the correct bank and branch.

In other words, the combination of a bank account number and sort code given to you when you open an account is unique. Think of it like your account's secret handshake. It's unique to you, like a fingerprint. When you want people to send you money in the UK, just pass on your account number and six-digit sort code. Easy peasy! You'll get your cash hassle-free.

So the next question is, which bank should I go with for opening an account?

Online-Only Banks

As a Gen-Z, I do everything online. So of course I would recommend the simple and efficient online-only banks first. The account opening process for most of these digital banks typically takes just a few minutes to an hour on your mobile phone. Here is a list of the most widely used digital banks in the UK:

• Monzo: Known for its user-friendly app and features like budgeting tools and instant spending notifications. This is the most popular online only bank in the UK, with the largest user base of more than 9 million as of 2024. The primary criticisms of the bank revolve around extended wait times for customer service and a perceived lack of features, such as international wire transfer. (User review rating: 4.7 out of 5.0)

• Starling Bank: Offers a full range of banking services with a focus on customer service and innovative features. Backed by U.S. investment banking giant Goldman Sachs, Starling is also one of the most popular digital banks in the UK and has a user base of 3.6 million customers as of 2023. The main criticisms also concentrate on sometimes slow customer service response time and limited international transfer features. (User review rating: 4.9 out of 5.0)

• Revolut: This is an interesting one. Revolut offers various online banking services, but it still has not obtained a bank licence in the UK as of mid 2024. As a result, it could only label itself as an e-money institution. Its product offerings focus on providing multi-currency accounts with features like fee-free international spending and currency exchange. Thus Revolut tries to differentiate itself from Monzo and Starling, focusing on the areas that these two banks are weak. Revolut has approximately 8 million customers in the UK. Common criticisms of Revolut include slow customer service responses, sudden account freezings/restrictions, some hidden fees or unfavourable currency exchange rates. Also because Revolut does not have a banking licence in the UK, its customers’ deposits are not covered by UK government’s deposit insurance scheme FSCS. (User review rating: 4.7 out of 5.0)

• Atom Bank: A digital bank that specialises in savings and mortgages, providing competitive rates and a user-friendly app interface. (User review rating: 4.9 out of 5.0)

Overall, setting up and using accounts with these online-only banks is straightforward and the fees they charge are usually low and reasonable. However, their product feature sets tend to be limited, and since they lack physical branches, customer queries are typically addressed via in-app chats, which can sometimes result in longer response times.

If you are need more sophisticated banking services, you should consider one of those High Street banks.

High Street Banks

• HSBC (Hongkong and Shanghai Banking Corporation): Based in London, HSBC is one of the largest banking and financial services organizations in the world. It offers a wide range of personal and commercial banking services, including current accounts, savings accounts, loans, mortgages, and investment products.

• Barclays: Based in London, Barclays is a multinational investment bank and financial services company. It provides various banking products and services, including personal and business banking, credit cards, loans, and mortgages.

• Lloyds Bank: Based in London, Lloyds Bank offers a range of banking and financial products and services, including current accounts, savings accounts, credit cards, loans, and mortgages.

• NatWest (National Westminster Bank): Based in London, NatWest offers a wide range of banking and financial services to personal and business customers. It is one of the largest banks in the UK and is part of the NatWest Group.

• Santander UK: Santander UK is a British bank and a wholly-owned subsidiary of the Spanish Santander Group. It provides retail and commercial banking services, including current accounts, savings accounts, loans, mortgages, and credit cards.

• Halifax: Halifax is a division of Bank of Scotland, which is a subsidiary of Lloyds Banking Group. It provides banking and financial services, including current accounts, savings accounts, mortgages, loans, and insurance products.

As you can see, these High Street banks have very similar product offerings, and you cannot go wrong with any of them. However, drawbacks such as lengthy account opening procedures, subpar customer service, and high fees detract from their appeal. They are also often criticised for being slow to adopt new technologies and innovate their products and services, resulting in outdated systems and processes that can frustrate tech-savvy customers like myself.

Insurance

If you are interested in buying insurance products in the UK, such as car, home, life insurance, you should check out the following comparison shop websites.

• CompareTheMarket.com: One of the largest and most popular comparison websites in the UK, offering comparisons for various insurance products including car, home, and travel insurance.

• Confused.com: This is the website that my parents use the most. It allows users to compare prices and features of various financial products and services, including car insurance, home insurance, energy tariffs, and more. Users can enter their details once and receive quotes from multiple providers, helping them find the best deal that suits their needs and budget.

• GoCompare.com: Similar to other comparison websites, GoCompare allows users to compare quotes for various insurance products, as well as other financial services like loans and credit cards.

• MoneySuperMarket.com: Another widely-used comparison website that allows users to compare prices and features for insurance products, as well as utilities, loans, and other financial services.

Medical Resources

If you plan to settle down in the UK as a student or general resident, you will need to join the United Kingdom's medical system, often referred to as the National Health Service (“NHS”).

NHS

NHS is one of the largest and most comprehensive healthcare systems in the world. Established in 1948, the NHS provides FREE healthcare services for all residents of the UK, funded through general taxation. In terms of international rankings, the UK's healthcare system is often considered one of the top in the world. It is recognized for its high-quality clinical care, medical research and innovation, and commitment to universal access to healthcare.

NHS offers a wide range of services, including primary care provided by general practitioners (GPs), hospital care, mental health services, and community care. It aims to provide equitable access to healthcare for all citizens, regardless of their ability to pay, and is based on the principles of universality, equity, and comprehensive coverage.

However, like any healthcare system, the NHS faces challenges in recent years such as funding constraints, workforce shortages, and increasing demand for services. One of the biggest complaints about the NHS has been the long waiting times for various healthcare services, including appointments with specialists, diagnostic tests, surgeries, and access to certain treatments or medications. Sometimes patients have to wait weeks or even months before they can secure an appointment with specialists or for surgeries. The wide discontent with NHS was considered a contributing factor for the broad support of the “leave” vote in the Brexit referendum in 2016.

Therefore, please remember that even though medical care in the UK is free, you should know that the system is not that efficient and be prepared to wait a fair amount time if your condition is not serious or life threatening.

General Practitioner (“GP”)

The first step in joining the NHS is to select a GP, who is usually the first point of contact when you are seeking medical care. As a result, you don’t want to choose a GP whose practices are located far away from you. In general, local GP appointments are quick and easy to make, so please take advantage of this convenience and

GPs typically work out of small clinics furnished with essential medical equipment needed for diagnosing and treating patients effectively. GPs play a crucial role in managing both acute and chronic medical conditions, referring patients to specialists if your condition is fairly serious.

To find a GP near you, please use NHS’ GP search site: https://www.nhs.uk/service-search/find-a-gp

NHS Emergency Service (Call 999)

If you encounter an urgent medical condition, you should call 999 right away, connecting with NHS EMSthat provides rapid response and pre-hospital care for medical emergencies. Trained paramedics and emergency medical technicians respond to emergencies, providing initial treatment at the scene and arranging transport to hospitals if necessary.

Hospitals

In terms of hospital visits, UK’s approach is different from countries such as China, where you can pretty much visit any hospital for consultation and/or treatment during work hours. In the UK, for non-emergency medical care, such as routine check-ups, consultations with specialists, or non-urgent procedures, it's typically necessary to make an appointment in advance. This applies to both primary care (visiting a GP or general practitioner) and secondary care (consulting with specialists or visiting hospitals).

However, for urgent medical issues or emergencies, you can go directly to hospitals or NHS walk-in centers without an appointment. For example, if you have a serious injury, sudden illness, or medical emergency, you can visit the Accident and Emergency (A&E) department of a hospital for immediate medical attention. Similarly, NHS walk-in centers provide treatment for minor injuries and illnesses without the need for an appointment.

Below is a list of some of the most reputable hospitals in the UK.

• St Thomas' Hospital, London: Founded in 1173, St Thomas' Hospital has a rich history and is located near Westminster Abbey in central London. It is part of Guy's and St Thomas’ NHS Foundation Trust and provides a wide range of medical services, including specialized care in cancer, cardiovascular diseases, and transplantation. St Thomas' is also known for its teaching and research activities.

• Great Ormond Street Hospital, London: Founded in 1852, Great Ormond Street Hospital (GOSH) is a world-renowned children's hospital located in central London. It specializes in complex and rare childhood diseases and conditions, including pediatric oncology, cardiology, and neurology. GOSH is closely associated with Great Ormond Street Hospital Children's Charity and is a major center for pediatric research and innovation.

• Guy's Hospital, London: Guy's Hospital, founded in 1721, is one of the oldest hospitals in the UK and is part of Guy's and St Thomas' NHS Foundation Trust. It is located near London Bridge and provides a wide range of medical services, including cancer care, urology, and orthopedics. Guy's Hospital is also a major center for medical education and research, affiliated with King's College London.

• King's College Hospital, London: Founded in 1840, King's College Hospital is a major teaching hospital located in South London. It provides a comprehensive range of medical services, including trauma care, liver transplantation, and neurology. King's College Hospital is affiliated with King's College London and is known for its research activities and innovative healthcare programs.

• Addenbrooke's Hospital, Cambridge: Addenbrooke's Hospital, founded in 1766, is located in Cambridge and is part of Cambridge University Hospitals NHS Foundation Trust. It is a major center for medical research and provides specialist services in areas such as neurosciences, oncology, and transplantation. Addenbrooke's is closely affiliated with the University of Cambridge and is a leading teaching hospital in the UK.

• Royal Marsden Hospital, London: Founded in 1851, the Royal Marsden Hospital is a specialist cancer hospital with locations in Chelsea and Sutton, London. It is the largest comprehensive cancer center in Europe and provides a wide range of cancer treatments and services, including chemotherapy, radiotherapy, and surgery. The Royal Marsden is also a world-renowned research institution, pioneering advances in cancer treatment and care.

• Royal Brompton Hospital, London: Founded in 1841, the Royal Brompton Hospital is located in Chelsea, London, and specializes in heart and lung conditions. It is one of the largest specialist heart and lung centers in the UK and provides a range of services, including cardiothoracic surgery, respiratory medicine, and cardiac imaging. The hospital is also a major research center, contributing to advancements in cardiovascular and respiratory medicine.

• Manchester Royal Infirmary, Manchester: Manchester Royal Infirmary (MRI) is a major teaching hospital located in Manchester, England. It is part of Manchester University NHS Foundation Trust and provides a wide range of medical services, including emergency care, trauma services, and specialist treatments in areas such as cardiology, neurology, and oncology. MRI is affiliated with the University of Manchester and plays a key role in medical education and research in the region.

• Queen Elizabeth Hospital Birmingham: Queen Elizabeth Hospital Birmingham is a large teaching hospital located in Edgbaston, Birmingham. It is part of University Hospitals Birmingham NHS Foundation Trust and provides a comprehensive range of medical services, including trauma care, transplant services, and specialist treatments in areas such as cancer, liver disease, and neurology. The hospital is affiliated with the University of Birmingham and is a major center for medical education and research in the Midlands.

• John Radcliffe Hospital, Oxford: John Radcliffe Hospital is a major teaching hospital located in Headington, Oxford. It is part of Oxford University Hospitals NHS Foundation Trust and provides a wide range of medical services, including emergency care, trauma services, and specialist treatments in areas such as neurology, oncology, and cardiology. The hospital is closely affiliated with the University of Oxford and is a leading center for medical research and innovation.

Canada

Canada

U.S.A.

U.S.A.

Chile

Chile

Bolivia

Bolivia

China

China

HK SAR

HK SAR

Japan

Japan

Korea

Korea

Singapore

Singapore

Thailand

Thailand

Philippines

Philippines

测试国家

测试国家

Germany

Germany

Russia

Russia

Spain

Spain

Sweden

Sweden

France

France

Luxembourg

Luxembourg

U.K.

U.K.

New Zealand

New Zealand

Australia

Australia

Zimbabwe

Zimbabwe

Botswana

Botswana

返回

返回